In Texas, more buyers are discovering the advantages of securing vehicles through car auctions Dallas, not just for selection and price, but for financing flexibility. But can you finance an auction car without hassle? Yes—and knowing how auction financing works gives you a serious edge over the competition.

This guide breaks down what buyers need to know: from getting pre-approved to avoiding risky traps and comparing financing options like Woodside Credit or local lenders. Whether you’re buying cars for business or personal use, you’ll leave with a plan that fits your budget and timeline.

Understanding Auction Car Financing

- Auction financing is a method to borrow money specifically for cars sold through auction houses.

- It differs from dealer financing, offering fewer perks but more flexibility on price and selection.

- These loans are ideal for budget-conscious buyers seeking used, rebuilt, or rare models.

- Available financing options may include traditional banks, Woodside Credit, and specialized auction lenders.

Unlike dealerships, auction platforms don’t always offer one-click financing. But with research and the right lender, buyers can secure funding that matches their purchase goals.

Who Offers Auction Car Financing?

|

Lender Type |

Pros |

Cons |

|

Banks |

Low rates, trusted names |

Less flexible with title issues |

|

Online Lenders |

Fast approval, easy pre approval tools |

May charge higher interest |

|

Auction Partners |

Know the auction process, quick loan release |

Limited to specific auction houses |

Exploring each category helps you match your credit profile and payment preferences with the right company. If speed is a factor, online lenders might edge out traditional banks.

How to Get Pre-Approved Before the Auction

- Gather documents: Income proof, driver’s license, and credit history.

- Apply early: Ideally 7–10 days before the sale.

- Select a lender: Choose based on rate, term, and reputation.

- Set your limit: Know your max bid before you step onto the lot.

- Print your letter: Bring your pre approved confirmation to the event.

Getting pre approval puts you ahead of the game. It speeds up your payment post-win and makes you a serious contender at car auctions.

What Credit Score Is Needed to Finance Auction Cars?

Expert Insight: Most lenders look for a minimum credit score of 600. Some accept 500 with extra conditions.

While a high score opens more doors, buyers with weak credit can still qualify. Expect a higher interest rate, shorter loan terms, or a required co-signer. Platforms like Woodside Credit offer flexibility with proper loan documents and pre approval.

Key Requirements Lenders Look For

- Stable monthly income

- Clean or rebuildable vehicle title

- Down payment (10–20%)

- Valid driver's license

- History of responsible credit use

- Clear intent to pay back the loan

To improve approval chances, align your application with these lender expectations. Some dealers at auction houses may also help with documentation support.

How to Finance a Car You’ve Already Won

- Contact your lender the moment you win.

- Submit final loan documents immediately.

- Finalize the loan within the auction’s payment window (usually 24–48 hours).

- Arrange for payment transfer or cash deposit.

- Pick up your vehicle with proof of sale and funding.

Delay here is costly. Miss the window and you risk penalties or losing your bid. Preplanning your finance process minimizes stress after a win.

Financing Risks and What to Avoid

Be wary of fine print, repair obligations, and auction deadlines.

- Late payment = forfeited car or heavy fees

- Salvage title vehicles often lack financing support

- Hidden damage not always disclosed at auctions

- Some auction houses charge post-sale fees that buyers don’t expect

Use industry tools like VIN decoders and vehicle history checks to prevent costly surprises. Remember, auctions work fast. Be ready before you bid.

Tips to Maximize Approval Odds

- Bring a co-signer with good credit

- Use budget calculators to plan ahead

- Stay under 45% debt-to-income ratio

- Know the auction house requirements

- Check the vehicle history early

These tips improve not just your approval odds, but also help you pay less in fees and interest.

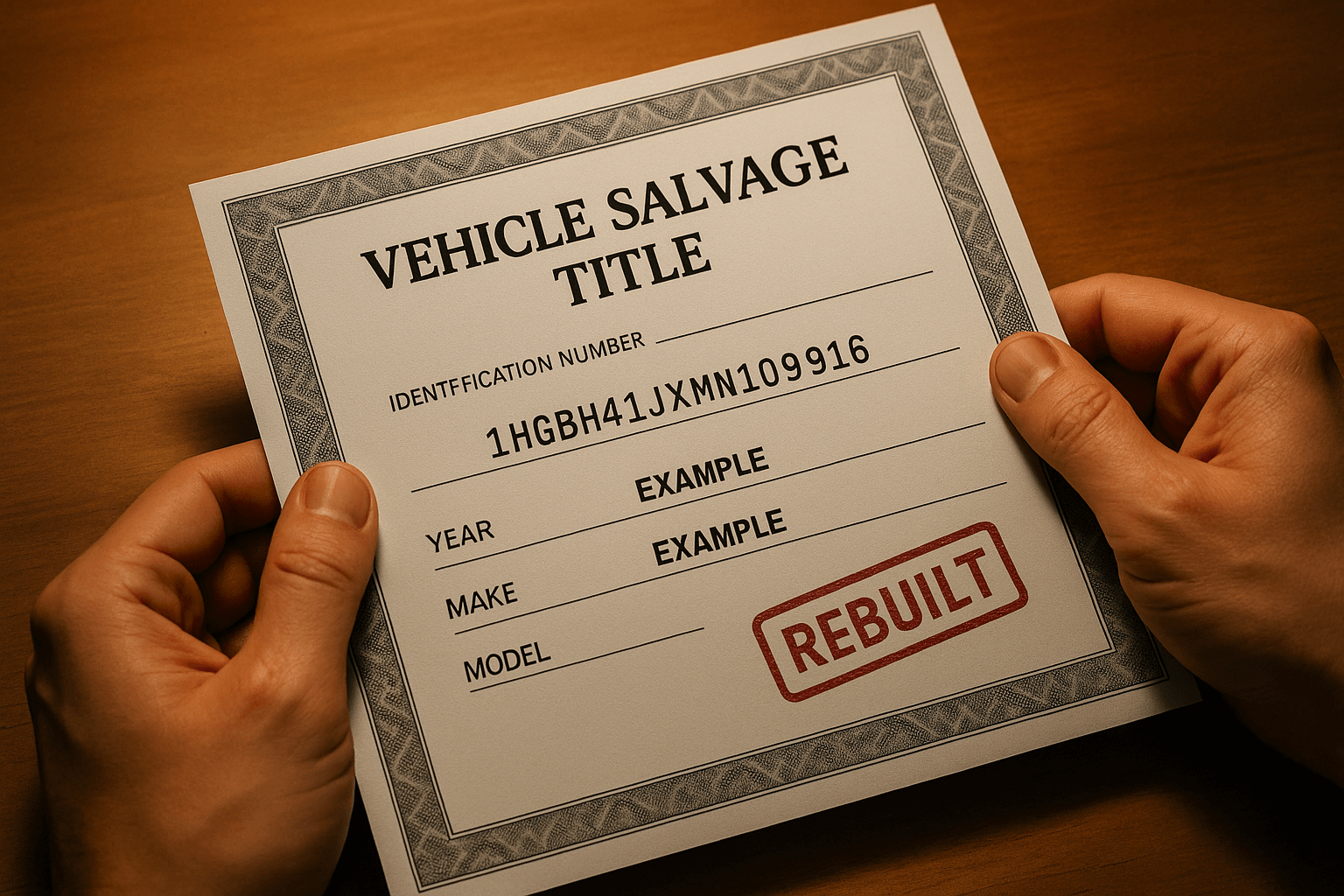

Can You Finance Salvage or Rebuilt Title Auction Cars?

- Yes, but only through specialty lenders

- Requires inspection and insurance pre-check

- Expect larger down payment

- Additional loan documents required

Most companies won’t touch a salvage title, but firms like Woodside Credit or niche lenders may offer structured financing options if the vehicle passes rebuild standards.

Differences Between Public and Dealer-Only Auction Financing

|

Feature |

Public Auctions |

Dealer-Only Auctions |

|

Eligibility |

Open to general buyers |

Only licensed dealers |

|

Transparency |

Limited vehicle details |

More access to industry tools |

|

Financing Access |

May require external lenders |

Often includes in-house finance plans |

|

Convenience |

Simple but fast-paced |

Complex but structured |

Understanding where and how auctions work impacts your financing options. For independent buyers, public car auctions provide broader access but fewer support tools.

What Happens If Financing Falls Through?

Emergency Tip Box

- You may lose your deposit or bid rights

- Some auction houses allow limited extensions

- Consider short-term personal loans to cover gaps

- Contact the auction immediately to explain delays

- Review auction cancellation policies in advance

Securing your payment before the auction begins avoids panic. If a deal collapses, backup loan options keep your purchase alive.

Pros and Cons of Financing an Auction Car

|

Pros |

Cons |

|

Lower car prices than retail |

Limited inspection time |

|

Access to unique vehicle inventory |

Fast payment windows |

|

Flexible budget planning via finance |

Some vehicles lack loan eligibility |

|

Helps establish credit or rebuild score |

Interest rates may be higher |

Every advantage comes with caution. Weigh both sides based on your goals and risk tolerance before choosing auction financing.

Final Checklist Before You Finance an Auction Car

- Prepare income docs and ID

- Use VIN lookup and research

- Compare available financing options

- Know your credit score and prequalify

- Choose lender: bank, Woodside Credit, or online

- Understand title restrictions (salvage, rebuilt)

- Know the auction payment deadline

- Budget for cash deposit and possible repairs

These steps turn a stressful process into a smooth vehiclepurchase experience—even at fast-moving car auctions.

Conclusion

So—can you finance an auction car confidently? Absolutely. But preparation is everything. Whether you’re bidding at car auctions dallas or exploring lender sites like Woodside Credit, pre-approving, budgeting, and verifying the vehicle are keys to success.

Remember, smart buyers don’t just chase the best price—they secure the right loan, align it with their timeline, and pay promptly. With a little effort upfront, auction financing becomes a practical, strategic move in the car buying journey.

FAQ Section

Q1. Can you finance a car from a public auto auction in Texas?

Yes, many public auto auctions in Texas offer financing through third-party or in-house lenders.

Q2. What credit score do you need to buy a car at an auction?

Most lenders prefer a score of 600+, but some accept 500 with higher rates and stricter terms.

Q3. Can I get financing after winning an auction car?

Yes, but fast action is required. You may only have 24–48 hours to pay, or risk penalties.

Q4. Do banks finance cars bought at auction?

Some do, especially for clean-title vehicles, but many avoid auction financing due to title risks.

Q5. Can I use a co-signer to finance an auction car?

Yes, a co-signer with strong credit can improve your loan chances and help secure lower interest.

Q6. Are auction car loans different from regular auto loans?

Yes. They involve shorter terms, faster approval, and stricter post-sale timelines.

Q7. Can I get pre-approved for a car auction?

Definitely. Getting pre approved streamlines the purchase and sets a clear bid limit.

Q8. Do lenders finance salvage or rebuilt title vehicles from auctions?

Some niche companies do, but terms are stricter and more documentation is required.